The truth is indeed that legal tender is simply a legal device to force people to accept in fulfilment of a contract something they never intended when they made the contract. It becomes thus, in certain circumstances, a factor that intensifies the uncertainty of dealings and consists, as Lord Farrer also remarked in the same context, 'in substituting for the free operation of voluntary contract, and a law which simply enforces the performance of such contracts, an artificial construction of contracts such as would never occur to the parties unless forced upon them by an arbitrary law.'

~ F.A. Hayek, Denationalisation of Money - The Argument

Refined: An Analysis of the Theory and Practice

of Concurrent Currencies, 3rd Edition, 1990

{Please note that the people who determine the “acceptable” length of a long email have designated this essay “too long” which should encourage you to arrange for independent email services. Running your own mail server is not that difficult. As I don’t make the rules, I am putting this note here at the top so you don’t experience the disappointment of getting all the way to the middle and finding out you have to scroll back to click over to the web version or the ‘stack app version. The Twisted Twenty-twenties can be kinda annoying ya know?)

If you are not familiar with the monetary standard of value writings of Thomas Henry Farrer, aka Lord Farrer, you are not alone. It is one of those topics that, in studiously avoiding, the cia information warfare operation “wikipedia” inadvertently highlights as very significant. It’s a strange time we live in, when those who claim responsibility for making available access to information (Google, Apple, Failbook, Wickedpedia, cia) are great enthusiasts of limiting access. Happily there continue to exist people able to remember the recent past and indexing systems far from the control of the Venetian dark ignobles. For the time being it is sufficient that FA Hayek was familiar with Farrer’s work.

Hayek’s 1990 release of his third edition of Denationalisation of Money was a very important event. I dedicated a series of essays on the topics Hayek brought up because these ideas are so vital to understanding what it is we are facing in the attempt by the globalist cabal of child rapists to establish a one world currency with digital control over everyone’s buying and selling.

Another important book that was heavily deprecated by the more effete members of the economics profession was The New Approach to Freedom by E.C. Riegel. My late friend Spencer MacCallum put together a Heather Foundation to put Riegel’s works on the interwebz and keep them there. So far so good.

There have been other important works on free market money. You would do well to read Murray Rothbard extensively. A good starting point is his What Has Government Done to Our Money which you can obtain free of charge at my friend Lew Rockwell’s Mises Foundation web site.

The Theory

The theory of free market money is very simple. Anyone should be free to issue currency. It doesn’t take much, especially in the current era of software mediated calculation.

EC Riegel pointed out that governments are the most inappropriate people to issue currencies because they are evil thieves and coercive frauds. The people most appropriate to issue currencies of their very own are entrepreneurs, business owners, and people who are productive. Ultimately, the only way for governments to redeem their currencies with anything of value is to murder, rape, and steal things of value from other people. Governments are unfit to be currency issuers because they are wicked, violent, and disgusting.

People who make shoes, however, could issue a private currency redeemable in shoes. Shoe-bucks would be available from various vendors, perhaps in paper coupon form, perhaps in digital form. You would be able to spend them at various shoe retailers, who might accept shoe-bucks issued by the companies whose goods they offer. You could bring $400 of Puma-bucks to a store and use them to buy a pair of Nikes if the store manager was comfortable with the transaction, and receive some $399.98 of Puma-bucks in change. (Yes, I intend to disparage the human traffickers who make their shoes with slave labour. kthx) The store then buys more inventory with the shoe-bucks from the issuer which accepts its money in the same enthusiastic spirit it would redeem a debt instrument at a profit.

Riegel addresses the question of how to evaluate the worthiness of a particular currency. Accountants can establish how many pairs of Puma shoes the issuer of Puma-bucks produces every year, and audit the issue of Puma-bucks. Then you as a consumer of free market money can be aware that there are ten times as many Puma-bucks in circulation than there are Puma shoe annual sales volume in bucks. Whereas there might be fifty million times as much Nicky-bucks issued by the people who make the Athena Nike brand compared to their annual volume of shoes. Nothing prevents you from converting value to the currency you choose. Caveat emptor and caveat venditor apply. Or simply say caveat omnis. Let the buyer and seller and everyone beware. Free markets don’t need coercion. In fact, coercion is damage and people find ways around it.

Obviously in this theoretical world of independent and sovereign individuals issuing their own currencies, there would be some who would allow accountants to audit their currency and others who would not. You would find a wide variety of web sites with lists of audited and unaudited currencies, and rankings, market capitalisations, and so forth. Consider, for example, CoinMarketCap.com and similar.

Now, the karenina of our world will say, and some will be paid to say, that without government, people would issue worthless currencies. It is so droll, isn’t it? As if governments themselves don’t already issue worthless currencies galore.

My late friend Clyde Harrison said, in 2002:

Fiat currencies don’t float. They sink at different rates.

What is a fiat currency? A fiat currency is a currency issued by a nationalist socialist bank, such as the filthy mass murder financing Bank of England, or the disgusting and sinful European Central Bank or the nasty unsightly and disreputable Feral Reserveless Scheme. It doesn’t have any value because it is not redeemable for gold or silver. JFK actually sought to expand the issue of silver certificate money before he was murdered and replaced by the venal, diseased, and wretched LBJ in a violent coup d’etat.

LBJ and his cohort of henchmen and his owner-operators at the cia wanted to issue as much money as possible. They found it difficult to do so immediately, but they did have LBJ remove the silver from the coins in defiance of the 1792 mint act (which says you can be executed for doing that sort of thing). Then they had their buddy Nixon betray the worldwide Bretton Woods agreement and end redemption of dollars for gold. They wanted to be able to destroy the middle class, plunder the poor even harder, and concentrate wealth amongst their friends and fellow demon worshippers. They also wanted to fund endless wars to send weapons around the world, encourage the rape and murder of children in refugee camps, and do other depraved and horrid things to mankind. Langley et Quantico delenda est.

What did Clyde mean about currencies floating? The concept that certain currencies were redeemable for dollars, and therefore for gold, from 1944 to 1971 was an important way for people to protect themselves from the more predatory gooferment paper issues. After 1971, the demon worshippers who run a certain publication for a particular Economist put forth the idea that all currencies would “float freely” meaning they would appreciate or depreciate in value depending on the actions and policies of a particular group of gangsters and their henchmen, known as politicians and bureau rats.

Hayek for his own part thought that not everyone was suitable for issuing currencies. He conceived of banking enterprises that would go back to their former product line and issue bank notes. Some bank notes would be redeemable for gold, some for silver, some maybe for a basket of currencies, and others would rely upon the management and business acumen of the particular banks. In this way there would be a market, doubtless the target for much regulatory “oversight” by which the bureau rats mean they overlook the crimes of people who pay them off while aggressively prosecuting people they don’t like. (See also “lawfare.”)

My own views tend more toward Riegel, since as far as I can tell, the singularly corrupt people in banking are also inappropriate issuers of currency. But, it is now completely out of my hands. No matter how certain Murray Rothbard was that only gold could be the proper free market money, we now have over 2.2 million currencies encompassing $2.5 trillion in market capitalisation and circulating $255 billion in value every 24 hours. That velocity of monetary exchange means that over $93 trillion in money will be moved into and out of the various crypto-currencies in a given year. By way of comparison the total forex market, the market for foreign exchange of all nationalist socialist currencies worldwide, runs to about $2.7 quadrillion annually.

The Past

One of the things that has always been true is: new businesses need financing. Traditionally, financing has taken a few forms. First, you can borrow money from people you know, or from a bank, or from a credit union. Second, you can get people to invest in the equity or capital stock of your company.

For thousands of years these were unregulated activities. People who had money to lend could lend it at any interest rate, require any collateral they wanted, and demand any terms. Because it was a highly competitive world, it was often easy enough to find terms that were reasonable. Yes, some people went to loan “sharks” and were taken advantage of, and some of those people had serious problems. Like an addictive personality disorder seeking the thrill of winning at gambling. Or a desire to use the borrowed money for extremely doubtful or criminal enterprises.

The problem was, to the way of thinking of the corrupt people of the world, it was really easy to be a lender. Enter the force and fraud of government. With government intervention, instead of a great flowering of banking and lending enterprises as one might suppose, there has been a dramatic consolidation. Instead of it being much easier to raise capital, it is excruciatingly difficult. Instead of being able to easily participate in free markets, it is insanely complicated to participate in regulated ones. Many people are actively prevented from having any opportunity, which is exactly what the venereally diseased Venetian ignobility want.

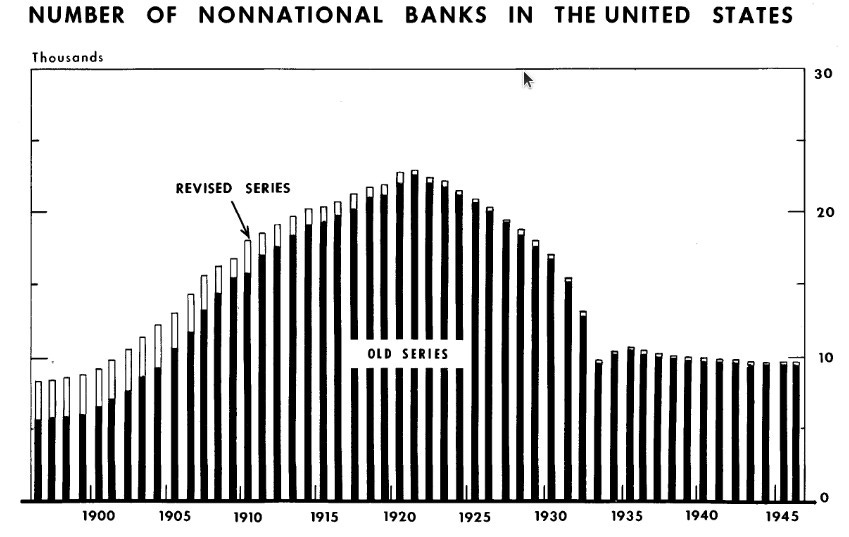

Bank consolidation has been a major goal for the nefarious demon worshippers in the banking cartel for a long time. You can see above a chart extracted from a 1959 document emitted by the Feral Reserveless scheme and stored on the St. Louis Fed site. Feel free to go find it if you wish. Several things become obvious at a glance.

First, the conditions that prevailed into the 1920s allowed for the formation and operation of around 23,000 banks in 1922. That is somewhat more than twice as many as had existed in the first decade of the 20th Century. Obviously the Federal Reserve deliberately attacked the economy in 1929-42 and the “war productions board” bureau rats continued the work to make it increasingly difficult to operate independent banks. Those trends continue to this day.

There are 4,236 FDIC-insured commercial banking institutions in the U.S. as of 2021 but 72,166 commercial bank branches. ~ Brian Martucci, Money Crashers.

In addition there are 4,760 federally insured credit unions. I didn’t locate a number of branches, but it may be on the same order of magnitude as bank branches. So there are probably about 130,000 or more locations needed to serve today’s population, but the total number of independent banking and credit union enterprises is under 9,000, where the total of non-national banks stood in the year 1896. In that year the population was around 68 million Americans compared to today when there are over 341 million Americans. Five times as many people are “served” by the same number of independent financial enterprises, plus the giant mega evil banking corporations.

Based entirely on the results of their efforts and ignoring entirely the foul lies and deliberate misrepresentations, the purpose of the Federal Reserve is to destroy independent banks, consolidate ownership of banking and lending enterprises, and make things as difficult as possible for commercial and individual borrowers. We can see they have been meaningfully successful. #EndTheFed

The founding of central banks has always been for one purpose: to finance the governments involved. The main goal of the people who put these central banking institutions together was the murder of hundreds of millions of people. I think it speaks volumes to their malicious intent and the degraded nature of their souls that they have been heartlessly cruel and relentlessly successful at their goal of slaughtering people. Here is how that worked out for humanity in the 20th Century:

To that bottom line figure of 262 million people murdered by their own governments, you have to add around 65 million killed in combat, in other military operations from disease, starvation, or other foreign imposed causes, and in the carpet bombing of cities. To those 327 million dead you should add at least 17 million killed by the vaxxajabs, around 78 million Falun Gong murdered by the Xi government in China, and tens of millions of Chinese dissidents, Uighurs, and other minorities. The people who have power in gooferments are killing mankind in wholesale lots, rendering large populations infertile with poisons and genetic treatments, and damaging infant and adult nervous systems with fluoride and other compounds. I’m having trouble finding synonyms for malevolent to match.

During the era of Queen Victoria in particular, there was a dramatic consolidation of the number of countries. By the time of the Eleventh Edition of Encyclopedia Britannica, the 1911 authoritative compendium of knowledge, there were about 113 countries in the world. Britain’s empire was one of the very largest, present in land claims on every continent. France was also very large. Even tiny Belgium had large overseas colonies. But after 1913 when the villainous European aristocrats had financing for their wars of obliteration, the number of countries began to rise once again. Today the United Nations has 193 member states, the Unrecognised Nations and Peoples Organisation identifies a further 42 members and dozens of former member sovereignties, and there are over 600 aboriginal or native sovereignties in north America, 2,000+ in Africa, and thousands more in Asia.

For the purposes of our current topic, there are lots of possible jurisdictions in which to operate data systems. Which means that “applicable law” can be pretty much whatever you choose.

The desire for ease of financing has been a feature, not a bug, of economic activities worldwide since as far back as there has been anything identifiable as money. Early documents suggest that gold and silver coins or uniform “pieces” were used for exchange four thousand years ago, including things that “historians” who rely on Herodotus’s claim that a Lydian king invented gold and silver coins around 600 BC call “buttons” but which are extraordinarily uniform in size, weight, and metal content, are present as grave goods, and pre-date Herodotus by thousands of years.

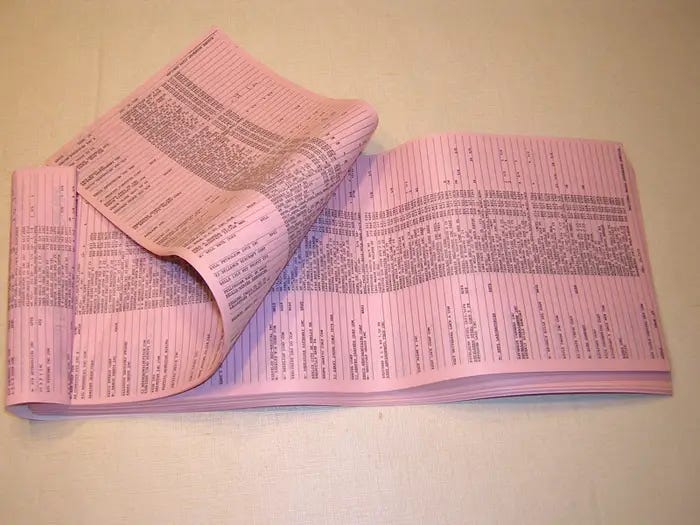

Pink sheets and yellow sheets are named for the colour of paper they were printed on, starting back in 1913 when presumably there were very low cost supplies of paper with these colours. Pink for equities, yellow for debts. There was no insecurities and exchange of power (sec) agency at the time, and nobody had to file anything with the gooferment to offer shares of stock or bonds to the public. It was a free market. People could also publish standing offers. Options to buy and sell would be added in the “Roaring Twenties” of the 1920s when Jesse Livermore began his practice of taking the other side of any options trade proposed. (Options contracts themselves go back at least as far as the ancient Greek named Thales.)

The iniquitous and dishonourable people who wanted an oligopoly to control the issue of equity and debt brought about the stock market crash of 1929, then used it as an excuse to dress up a bunch of rats in desk outfits (making them bureau rats) to be parasites on the market economy. The sec was founded in the Summer of 1934 to impose rules and regulations and pretend to care about market manipulation by any group other than congress critters.

But the pink and yellow sheets persisted, unto this day. So do stock and bond options. To be quoted on the pink or yellow sheets companies do not have to file anything with the sec, although some companies choose to do so. Some are even fully reporting companies and file their EDGAR papers every quarter. Some firmly established foreign firms are quoted on the Over the Counter (OTC) listing markets mostly through American depositary receipts. Small, closely held, and thinly traded companies are also mainly traded on OTC market platforms. These are now primarily digital markets and the use of paper publishing has gone away.

In the 1960s a guy at Wharton read a book by Braddock Hickman, formerly of the feral reserveless bank of Cleveland. In it, the evidence was presented that a portfolio of high risk bonds could have a greater risk-adjusted return on investment than a portfolio of low risk bonds. The guy was Michael Milken and his professors helped him land a Summer job with Drexel Harriman Ripley. The Harriman part of that company was the remains of the Brown Brothers Harriman after the Glass Steagall act of 1933 required that deposit banks separate their commercial banking operations into independent companies.

Harriman and Ripley combined with Drexel around 1965 and the company went through other mergers, becoming eventually Drexel Burnham Lambert. Milken would come to head the high yield bond operation of the company. From 1970 to 1987 he had control over capital and made trades, profitably in every month except four. His success led to a 1976 compensation package of $5 million. (At the time, that would buy about 40,064 ounces of gold, which today sell at about $86.3 million. Nice work if you can get it.) His prominence led him to move the high yield bond trading business to Century City in Los Angeles, which probably made him no friends among the politically connected on Wall Street.

In the mid-1980s, thinking they were protected by their connexions to John Glenn and other prominent politicians (see “the Keating five”) the Savings and Loan banks began failing due to taking on excessive risk. Almost certainly as a scape goat operation, Rudy Giuliani picked on Milken and Drexel Burnham in 1989 to make a high profile case. Using testimony from snitch Ivan Boesky to gain an indictment, Giuliani as Ronald Reagan’s administration’s US attorney for the Southern District of New York gained convictions in his “investigation” which led to the imprisonment of Milken and the bankruptcy of Drexel. Having himself on camera arresting white collar “criminals” and parading them in handcuffs for the cameras probably helped Giuliani’s political career in becoming mayor of New York 1994-2001, helping to cover up the GW Bush attacks on World Trade Center buildings 1, 2, and 7. These events helped convince me that the system was largely corrupt and to stay out of finance for a while.

Another aspect of the past that bears discussing is the atrocious, unprovoked, and brutal attack by the bureau rats of the alcohol tobacco firearms explosives and shooting the family dog (batfesfd) agency against Texans in a church and abbey near Waco in 1993. The nasty child rapist, Epstein buddy, and sex offender Clinton wanted to start his administration off with violence at home as well as with his troop deployments to attack the independence of Somali people abroad. So he and his wife, the blood drinking Hillary, had the batfesfd parasites stage an attack on the Mount Carmel religious community. They lied to the Texas national guard and used military personnel in a combined air and ground assault without briefing the governor of Texas, ending federal adherence (spotty at best over the decades) to the terms of the settlement of the Civil War, the posse commitatus act.

Outraged by the subsequent depraved and execrable torture of infant children with poison gas and the despicable deliberate burning of the entire community, many Texans reacted in support of an restoration of an independent Republic of Texas. The feral, that is wild and insolent, gooferment had aroused considerable ire by burning seven dozen Texans to death, deliberately, maliciously, and purposefully. I took notice of these events by going to a gun store that Summer and buying my first rifle.

By 1997 there were several groups in Texas active on the topic of independence. In the Davis mountains Richard McLaren was holding out in the embassy structure for a while, but that standoff led to his arrest and the death of Mike Matson. Meanwhile a group put together in part by newspaperman Wes Burnett and gold enthusiast Don Henson began drafting “Texas Constitution 2000” with the goal of seceding from the USA by asking individual county assemblies to ratify the document. In the 12th month of 1998, I was asked to put together the ratification project. We drafted a plan and in 1999 we were able to secure the ratification of Sabine county. After that, Bob Phipps led a whispering campaign and the project was destroyed. I should probably mention that the Texas constitution ratification project led me to start my first e-gold account and also led to my subsequent appearance in Den Haag, the Netherlands to deliver documents from the provisional government of the Republic of Texas to the Unrecognised Nations and Peoples Organisation which, of course, chose to ignore the opportunity to accept Texas onto its list of independent national sovereignties. (“Commie is as commie does, Lt. Dan.”)

You may have noticed that this discussion of “the past” is covering a lot of topics and territory. One of the things that God arranged for me was what my high school Shakespearean literature teacher, Mrs. Fambrough, called “a varied experience.” I know a bunch of things about a bunch of different topics, including from direct personal experiences. All these threads hang together, though, so let’s continue to build up the loom, as it were, before we finish the fabric.

Another interesting thread relates to the company Enron which came together in 1985 as the merger of two big natural gas companies. Gas pipeline operations for common carriers became significantly deregulated under the Reagan and elder Bush era. Energy contracts of certain kinds had been a commodity for some time, and this trend continued in the late 1980s and early 1990s. Enron established a gas bank that allowed gas producers and wholesale buyers to purchase gas supplies and hedge the price risk at the same time. Enron expanded internationally and established an energy exchange market in Houston.

Their difficulties certainly included a tendency to enthusiastic accounting practices, dating back to a 1987 activity that led to two convictions in 1993. However, their main problem was, they had created an exchange that big companies like JP Morgan Chase wanted to acquire. As I recall the discussions in the mid-1990s amongst my fellow Rice business school alumns, it was also Citigroup that cast an envious gaze upon Enron. The directors of Enron didn’t want to sell. Whoops. It is arguable that Enron became a widely known scandal both because of its internal bad practices and because it was the target of hostile take-over intentions. In any event, it gone now.

In the year 1995 a cancer doctor in Melbourne, Florida, started a company offering digital gold warehouse receipts. He quickly added silver, platinum, and palladium. At first the gold was in the form of coins and small bullion bars kept at the company headquarters. It was still mostly this way in 1998 when I first became a customer. Sometime in 1999 I sent in the redemption order and claimed some tenth-ounce gold coins. As I recall these included a Swiss franc piece and a Dutch guilder piece. Kinda nice.

Around Anno Domini 2000 there was considerable effort to put the e-gold operation on a sounder footing. Gold and other precious metals were warehoused in the form of 400 ounce “good delivery bars” in Dubai, Zurich, and London. Coins were no longer accepted for bailment. An effort to move the servers offshore ran into a sharp operator who wanted to subvert the software on the servers, so these were kept at the headquarters in Florida. Terms of service were dramatically improved. “Dust” incentive payments for new account recruitment and for the activities of those new accounts motivated the rapid expansion of a complete economy. By 2002 there was a “Gold Economy” conference in Atlanta with some of the luminaries of the industry like Doug Jackson, founder of e-gold, and Pamela Fayed, founder of e-Bullion in attendance. Me, too.

It was that same year when I first met James Turk and his son Geoff, as well as Anthem Blanchard at the event that I call “the Blanchard gold show.” All the way back in the early 1970s a perfidious traitor named tricky Dick Nixon ended the last connexion between the dollar and gold, nationalised the railroads, and ended the space programme’s more robust activities.

In the first month of 1973, James U. Blanchard III hired an aeroplane to fly a slogan “Legalize Gold” over the inauguration of the tricky Dick. About a year later, he and his business associates invited all the gold bugs they could contact to an event in New Orleans. Today it is still going strong, 50 years later, as the New Orleans Investment Conference. Back then, Jim Blanchard wheeled up to the rostrum, took a ten ounce gold bar out of his briefcase, slapped it on the podium, and said, “I’m an American. That’s ten ounces of gold. Come arrest me.” There was much rejoicing. No arrest took place. Later with motivation from some campaign contributions, Gerald Ford legalised the private ownership of gold by Americans, or, anyway, rescinded the disgusting and unconstitutional edict of FDR claiming it was illegal. As a result of my connexions in the ensuing years, after meeting Jim’s son Anthem, I joined the Gold Anti-trust Action committee (GATA).

Circling back briefly to the mid-1990s a guy named David Chaum tried to expand something called DigiCash. Chaum is famous among cypher-punks for developing in 1982 the blind signature technology to ensure the anonymity of digital transactions. At that time, public and private key encryption standards like RSA were establishing the open source cryptography movement on very solid ground. Chaum was successful at convincing Mark Twain bank in Missouri to accept and exchange his issued DigiCash. Alas, the venture folded in 1998 just before the hey-day of various digital monetary offerings. Some of us remember beenz and flooz. Peter Thiel and associates founded PayPal as “Confinity” late that year, and a group in Moscow started WebMoney in response to the currency crisis in Russia that same year. (You should look into Jim Rogers and George Soros and their work in various currency crises when you have some time.)

I could write several book-length treatments on the early history of the digital gold and digital cash industries. But for now I want to briefly mention two further threads. One is the 2001 release of the web site of the Private Venture Capital Stock Exchange operating from Vanuatu. My old friend Sidd Davis came up with the software and issued the first stock on the exchange for “Pecunix Venture Holdings.” In 2003 one of the companies with which I was closely linked acquired PVCSE and issued our own stocks on the exchange.

Meanwhile, in another privacy-respecting offshore jurisdiction a group led by JP May of Interesting Software had build The Gold Casino. It allowed visitors to gamble in normal casino style games and accepted various digital gold currencies as well as some digital cash offerings. They were enormously successful in the 2002-2003 timeframe and began somewhere in those years to issue stock and offer it on their own digital stock market. Some companies I was involved in bought some shares. In 2004 we established a stock on PVCSE called “Micro Casino Gold” which was simply the opportunity to own one millionth of a share of The Gold Casino. We were delighted by the response, and ended up owning several shares of The Gold Casino and issuing several million shares of Micro Casino Gold. As I recall, The Gold Casino paid dividends which was the main attraction of its shares, and we arranged to pay dividends to holders of Micro Casino Gold as well.

By the beginning of 2007 we were in negotiations to list about a dozen new companies on PVCSE. There were over $50 billion in economic transactions on the e-gold servers, which published statistics updated with every transaction. The number of gold bars in inventory had been on an exponential growth curve for at least five years, and was looking to lift off. So, naturally the bureau rats at the fbi arranged to make some false claims, put together a bunch of false evidence, and arrested the founder of e-gold. My friend Carl Mullan put together a detailed book on the topic, so I won’t belabour the matter further. If you don’t like my link to Bookwire the title of Carl’s book is Better Money: the inside story of e-gold.

I also won’t spend much time on the topic of how completely destroyed the digital gold economy became as a result of this event, the subsequent Autumn 2007 destruction of Liberty Dollar for daring to issue a Ron Paul coin, and the 2012 decision to make GoldMoney no longer a medium of exchange. Pecunix was also destroyed in this period by the theft of its gold bars by a Swiss banker of dubious merit.

As a result of these events, there was much talk in 2008 about what to do. Obviously centralisation presented a lot of difficulties. If all the software is on one server, and the ferals steal that one server, everyone’s store of value and every transaction event is also stolen. If the gold and silver are stored in known warehouses, the seizure of those bullion bars means the value is stolen. And very few places in the world are willing to ignore a seizure warrant from InterPol. Obviously the people who had silver pieces distributed by Liberty Dollar always had silver in their hands, so they were the least damaged by the attacks. But it was some grim days for many of us.

The answer, and the culmination of this section of the topic of free market money, arrived in the 10th month of 2008 in the form of the Bitcoin white paper. You can find it online in various places. The white paper and the Bitcoin software development project led to the Genesis block in the first month of 2009. Much has changed in the last 15 years, but the foundation of a decentralised store of value that also established an effective decentralised medium of exchange was an essential event.

Free market money has not been the same since then.

The Present

So we come to the current day, and a fine day it is. The people who are actively seeking to impose tyranny in the USA have made themselves known. Many of them hang their head gear at places around Langley and Quantico. Some in the central District of Corruption. At the very same time, their friends in the Rockefeller, Morgan, Chase, Soros, Schwab, and Harari families have made known their intentions to impose a global totalitarian system of government supremacy for the purpose of enslaving mankind, raping children, drinking the blood of terrorised toddlers, and doing other extremely disgusting things to one another and their many victims.

Jurisdictional arbitrage is a term that I began using back in the 1980s on some internet relay chat, bulletin board systems, and USEnet newsgroups. Its possible that it originated with me, because I was familiar at the time with both the concept of arbitrage and the issues surrounding jurisdiction in enforcing laws and regulations. In any event, it is a topic for much musing.

When the gooferment destroyed Space Travel Services in 1991 and then admitted, a few months later, that they had indeed lied about the criminal charges of felony gambling promotion of a lottery, I began looking for a free country.

Not knowing that there are none, but strongly suspecting that the efforts of the cia to destroy the Republic of Minerva in the early 1970s was a significant feature of the current era, I spent quite a long time reading up on the topic. Later, I would spend some time in South Henderson, Nevada with Chuck Geshlider and Eric Klien working on their version of The Atlantis Project. A few years later I would be introduced to Spencer MacCallum who had worked on an earlier Atlantis Project founded by Werner Stieffel. As a result of not getting along with Chuck, I went back to Houston and composed and published my first book The Atlantis Papers which was read by Courtney Smith.

Courtney liked it and called me up one day to talk. I found out a lot of interesting things in the Summer of 1994 about what went wrong with the Atlantis project in Nevada. Courtney asked me if I thought he should start a foundation to pursue ideas related to new countries. I was very enthusiastic in favour of this idea. So there is a great deal more to be said on this topic in future essays. Suffice to say, if you want to be free, you would be wise to consider the possibility that just one country isn’t going to do everything you may want in terms of governmental procedures.

You might look into the Five Flags strategy to have more than one passport, more than one country where you do business, and more than one physical home in differnt countries where you can live in case things go dramatically awry in one of the others. You might also look into a strategy that Courtney seems to have adopted, becoming a permanent traveller and not really being resident in any country. Ultimately, however, you should remember that the entire universe and everything in it belong to God the Father Almighty, Creator of heaven and earth. So Freeman Dyson’s idea that “once we’re in the asteroid belt, the IRS will never find us” has considerable merit. Governments are temporary things, mostly nuisances, and definitely grifts.

Pink sheet deprecation is a topic worth mentioning. If you go look for a stock that is only listed in the pink sheets, or on various over the counter markets, you may find that your stock brokerage account service won’t let you buy any. Some of the retail biggies are vehemently against letting ordinary humans buy OTC listed stocks. Others will let you, but you have to jump through some hoops, aver that you are in fact sophisticated and aware of the risks.

The maleficent reprobates at the sec hate humanity and want to enslave mankind. Under Gary Gensler they have made it clear that they don’t want to tolerate the OTC markets. They want to make it as hard as possible for people to raise money for their new businesses. They want to make it nearly impossible for you to invest in anything, because they view all Americans as slaves who belong to the nationalist socialist imperialist government and, as government supremacists (hat tip Bill Buppert) they are against freedom and individual sovereignty.

Meanwhile in the last fifteen years, the Gold Anti-Trust Action committee has done quite a bit to expose the commodity exchange oligopoly and the blatant manipulation of the prices of gold and silver. If this topic interests you, feel free to follow up in the comments. You’ll find that a number of the big bullion bankers, like JP Morgan Chase in particular, have been fined for their disgusting behaviour. Here’s a news article about them being required to disgorge, a delightful image of a carrion eater vomiting up a carcass if ever there were one, and do other things to pay restitution. Of course, the company execs were not put in prison for decades, so they simply chalked it up as a cost of doing business and kept doing the same garbage.

Again, there is a rich carpet to be made of the many threads here of perfidy, incontinence, corruption, regulatory capture, and repulsive malignance in the commodities business. The Chicago Mercantile exchange became CME Group and was encouraged to buy a bunch of other exchanges. Clinton had congress repeal Glass Steagall. The exchange oligopoly is real and the manipulation of spot and futures contract prices is widespread in many industries. The executives in charge of JPM, Wells, Citi, opium wars bank HSBC, Gold Mansacks, and Spank of America are arguably some of the worst people in earth. JPM in particular was deeply involved in the control of politicians and business execs by Jeffrey Epstein and Robert Maxwell’s daughter. A lot of children have been raped for the perverse people who want to destroy individual liberty. A reckoning comes.

But I shall wax eloquent on those topics another day. Today, I would like to focus your attention on the 2.2 million crypto currencies, the top 100 of which have trillions of dollars of value. I want you to understand that it is pretty easy to issue a new currency, and for the last ten years a lot of companies have done so. Some are now using the “white paper” of their crypto coin as a substitute for a business plan (which, as the author of hundreds of business plans and white papers, I can attest is a key element to understanding whether a company is going to succeed) and using coins as ways of raising money.

Several of these currencies are actually more like platforms. Ethereum was interesting in its classical days because it came with its own programming language, so you could establish as “smart contract” that fulfilled itself when conditions in the contract were met in the real world. Unfortunately, this led to the Classical ETH hack, which led to the fork, which led to the new-Coke version of Ethereum. But the Ethereum virtual machine (EVM) is a thing, and it creates an economy unto itself.

NEAR is another token with its own coders and its own platform and its own EVM of sorts. Given the continuing interest of some of my friends like Arto Bendiken and some of the great cypherpunks like Frank Braun, I suspect NEAR is going to be very interesting in coming years.

The Future

The future of free market money is very simple, in terms of themes, and very complex in terms of coding and implementation. I should probably start by quoting one of the great authors of our current era, John Gilmore. John created the “alt” part of USEnet which became for many people the most useful and interesting part, and did great things in founding and helping to lead the Electronic Frontier Foundation. If you want to know about privacy technologies, you should spend quite a bit of time with the Electronic Frontier Foundation’s web sites. Here is one of his most famous statements:

The Net interprets censorship as damage and routes around it.

Up top I have modified this saying to “Free people interpret coercion as damage and route around it.” The point is that free markets don’t need regulators. To the extent that we need anyone inspecting goods and services for quality, there are lots of private enterprises built on that need: Good Housekeeping and Underwriters Laboratory are two that come to mind.

What do people want with money? They want a store of value, a medium of exchange, and a unit of account. They want privacy and autonomy. They want to be able to easily issue new money, new shares of stock in wholly new enterprises, new debt instruments, and to be able to buy and sell and option these things any time, anywhere, and for any reasons. They want, to quote a film I’ve enjoyed watching, “To come and go like the wind, to be invincible, invisible, and invulnerable.”

What we have, today, if I am any judge of current events, is a mess. I’ve been involved in a lot of companies since founding “Green Power” back in 1975. I’ve been in recycling, lawn care, newspapers, printing, publishing, writing, editing, tutoring, teaching, communications skills, communications technologies, software, hardware, 3D rapid prototyping, practice management, aerospace, oil and gas, mining, digital gold currencies, digital cash systems, private stock markets, cryptocurrencies, cryptography, astrophysics, economics, history, and poetry. I’ve studied accounting since 1981 and applied it in banking, finance, and fund management. Recently I began working with some people who do “introduction brokerage” in debt and cryptocurrencies. I’ve worked with the world’s greatest trader in forex, crypto, commodities, options, stocks, and bonds. So, I do believe I am able to evaluate the current situation. “Mess” is one of those short little words in our language that describes a lot of things made by people.

There ought to be easy ways to permanently store information. FileCoin has some of that technology. There ought to be easy ways to exchange money for goods and services with great privacy. ZCash, Monero, and PirateCoin have some of that technology. There ought to be easy ways to issue stocks and bonds and trade them on digital markets accessible worldwide, and there are some poseurs in this area of activity but no clear winner.

It ought to be possible to do business without getting permission from a bunch of parasites. There are some countries that make that easy for locals and hard for travellers. There are a few countries that make it easy for everyone, and they are mostly regarded, like Singapore, as very uptight in a lot of ways.

The world needs free countries, free markets, and freedom technologies. Most of all, the world needs you to be free and sovereign. Because if we don’t fix these things, there is going to be a much bigger mess.

A reckoning comes. People are going to be a big part of many aspects of that reckoning, because once it is clear what has been done and how little can be changed by peaceful means, there is going to be a lot of anger and a lot of retribution.

God is moving in our world as always. So I invite you to make plans and pursue them. And remember that changes are coming. Big changes. God prevails. God’s will be done. Amen.

That’s all I’ve got for today. Come back next time when I have something new. Or old.

Thank you, Jim, for the trip down memory lane.

For me, that trip is topped off by the (recent) invention of Goldbacks. Goldbacks have corrected ALL the problems of the Liberty Dollar...AND added features that have never before been available. JP Morgan said "Money is Gold" [ https://www.tinyurl.com/Money-is-Gold ] and Goldback is the first "alternate" money that I have ever recommended to my friends...because...:

“Goldbacks are not a promise to pay in gold, they are the gold!”

https://www.goldback.com/

Best regards,

Dennis Wilson

DennisLeeWilson@Yahoo.com

Signatory: Covenant of Unanimous Consent

"It is not enough to know what you are against.

You must also know what you are for."

The Covenant of Unanimous Consent IS

The Bare Minimum: A New Form of GovernANCE

Based on the Non-Aggression Principle

https://tinyurl.com/The-Bare-Minimum-W

÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=÷=

Enjoyed the explanation of free market money & review of digital gold's rise /growth/ fall; bitcoin/crypto's significance.